Did you know that over the last year the Ariel Accounting team has taken on the role as IRD tax agents? We are thrilled to announce that we can now not only offer this service for our current clients but to other small businesses in the Waikato region. With our extensive expertise in tax compliance and dedication to providing personalised financial and bookkeeping services, we are excited to offer our assistance to help local businesses navigate the complex world of taxation.

At Ariel Accounting, we understand that managing your small business’s tax obligations can be overwhelming and time-consuming. That’s why we have expanded our services to include tax agency representation, aiming to provide comprehensive support tailored to your unique business needs. Our team of Sarah, Maree and Kasey is committed to ensuring that you receive accurate, compliant, and optimised tax returns, allowing you to focus on what you do best: growing your business.

“We’ve always assisted our clients with their tax and helped them prepare the information for their tax returns. It’s now great to be able to carry that one step further and lodge and manage tax returns on behalf of our clients.”

Sarah Cowan – Owner Ariel Accounting

By choosing Ariel Accounting as your tax agent, you can expect not only meticulous attention to detail but also personalised service that puts your business’s success at the forefront. We pride ourselves knowing our customers and their businesses. We work with people, not just the numbers, we know who you are, who your team is and what the challenges are you may be facing. We take the time to understand your unique financial situation, allowing us to tailor our services to best suit your needs. We’ll do as much or as little as you need.

Our goal is to help you navigate the complexities of the tax landscape seamlessly, ensuring compliance, minimising your tax liability, and providing peace of mind throughout the process. Using us for your day to day bookkeeping and for tax completion will save you time and money as we have worked with you throughout the year, understanding your business, systems, accounts and gathering relevant information as we need it.

Whether you are a sole trader, partnership, or small company in the Waikato region, Ariel Accounting is here to support you in your tax journey. Our team is dedicated to building long-lasting relationships with our clients, providing ongoing guidance, and being a reliable resource for all your tax-related queries.

Why use us as your tax agent?

- Expertise and Knowledge: We are professionals who work with you to understand your business and will ensure that your tax return is prepared accurately and in compliance with the relevant tax legislation. Although we are small team, we know our clients well and the challenges they face.

- Time and Effort Saving: Handling tax matters can be time-consuming, especially for small business owners who already have so much to do already. Many of our clients also use our bookkeeping services, so we understand what has happened over the course of the tax year and where to gather information. By engaging us a tax agent, you can offload the burden of tax preparation and compliance, allowing you to focus on running your business.

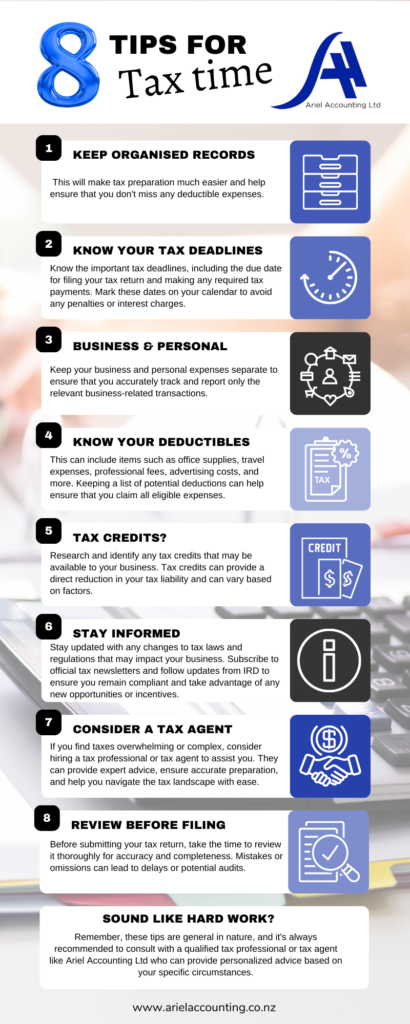

- Compliance and Avoidance of Penalties: We stay up to date with the latest tax information, reducing the risk of non-compliance. We are familiar with the specific deductions, credits, and allowances available for small businesses, helping you maximize your tax benefits. By ensuring accurate and timely filing, we help you avoid penalties and potential legal issues.

- Tax Planning and Optimisation: We can assist with tax planning strategies tailored to your business, aiming to minimise your tax liability within legal boundaries. We can identify potential deductions, exemptions, or tax credits that you may not be aware of, ultimately optimising your tax position and potentially reducing your tax burden.

- Assistance with Audits and Inquiries: If your small business faces an audit or inquiry by the tax authorities, having a tax agent can be immensely beneficial. We can guide you through the process, represent your interests, and help ensure that the audit or inquiry is conducted fairly and accurately.

- Peace of Mind: Engaging us your tax agent can provide peace of mind, knowing that your tax affairs are in capable hands. We like to deal with people, not just numbers. To us you aren’t just a small fish in a big pond as you may be with a larger firm. By relying on our expertise, you can feel confident that your tax returns are prepared by someone that cares, are accurate, compliant, and filed on time, reducing stress and allowing you to focus on your core business activities.

Let us navigate the intricate tax landscape while you focus on what truly matters—building and growing your business. Contact us today to discuss your unique financial needs, explore how we can tailor our services to your business, and discover the benefits of having Ariel Accounting as your trusted tax agent.